are union dues tax deductible in nj

Federally health insurance uses pretax funds union dues is subject to expenses in excess of 2 of AGI. Union Members May Opt-Out of Paying Dues.

Deducting Union Dues H R Block

Union Dues Deduction The Company will deduct union dues from new employees who have worked a minimum of forty 40 hours.

. New Jersey follows the federal rules for deducting qualified Archer MSA contributions. UNION DUES CANNOT BE DEDUCTED FROM GOVERNMENT EMPLOYEES IN New Jersey WITHOUT CONSENT. On June 27 2018 the United States Supreme Court issued an important employment law decision in the case of Janus v.

You would only get a benefit if other factors allowed you to. Local 196 dropped any claim for union dues fees or other monetary compensation from the plaintiffs from January 1 2022 on. However with the introduction of new tax reforms unreimbursed employee expense.

If youre self-employed you can deduct union dues as a business expense. Because of the recent Supreme Court ruling in Janus v. This prohibition was written into the tax reform legislation.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. However the costs associated with. The bus drivers also are due a refund for union.

Elected officials of the union set union dues and typically. Your contribution cannot be more than 75 of your annual health plan. This provision rewards labor union.

Tax Deduction for Union Dues. Prior to the 2018 tax year workers were able to deduct union dues check-offs. Dues and any employee expenses not itemized by an employee are no longer tax-deductible regardless of whether they itemize deductions.

June 4 2019 1112 PM. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues. Section 138514 gives union members an above-the-line deduction for up to 250 for their membership dues.

However most employees can no longer deduct union dues on their federal tax return in tax. Union Dues Deductions It shall be a condition of. Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions.

Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act. Please note that tax payers can now itemize deductions on state.

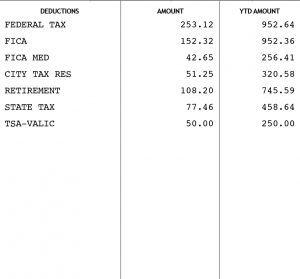

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report

Can You Deduct Union Dues From Federal Taxes

The Wandering Tax Pro January 2019

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Lambertville Halloween Film Festival Arts Cultural Council Of Bucks County

A Complete Guide To New Jersey Payroll Taxes

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report

A Complete Guide To New Jersey Payroll Taxes

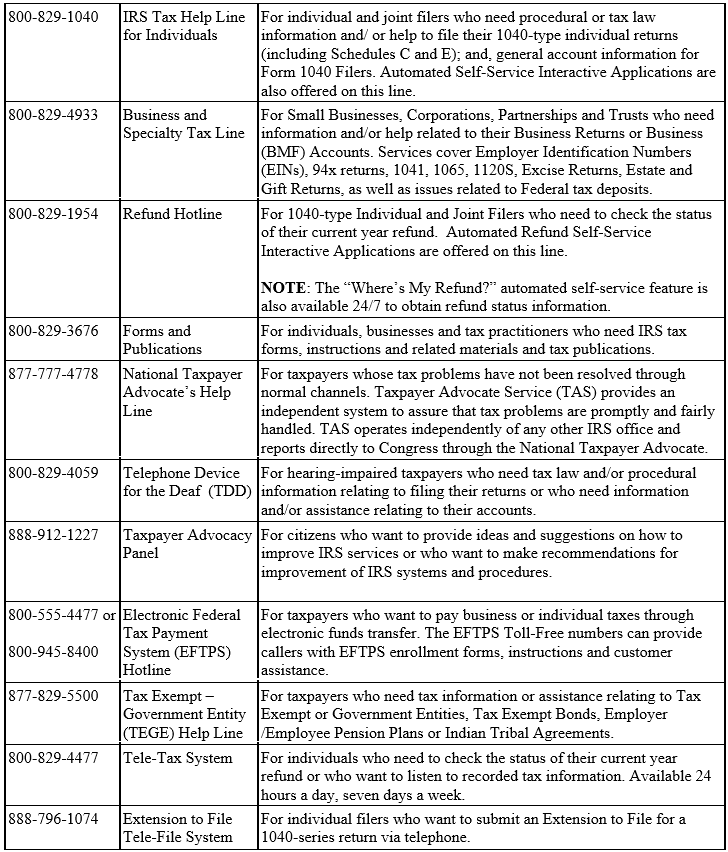

It S Tax Time Remember Union Membership Dues May Be Deductible Nteu Chapter 280 U S Epa Hq

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report

It S Tax Time Remember Union Membership Dues May Be Deductible Nteu Chapter 280 U S Epa Hq

Tax Deductions The New Rules Infographic Alloy Silverstein

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)